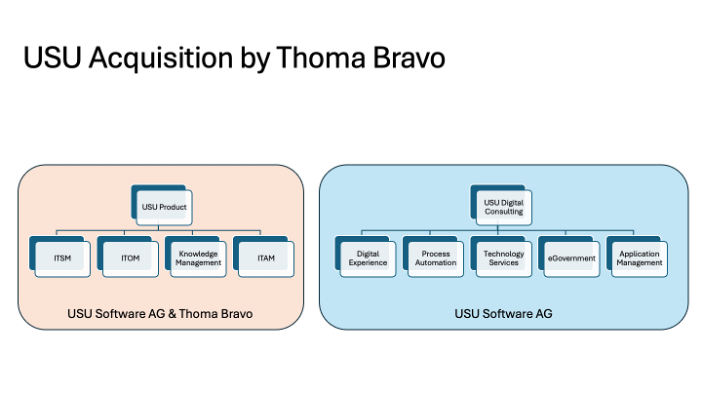

Private Equity firm Thoma Bravo, owner of Flexera, just announced its intent to acquire a new corporate entity USU Product, subject to regulatory approvals. The new USU Product company brings together USU’s ITSM, ITAM, ITOM, and Knowledge Management products. Alongside Thoma Bravo, USU Software AG (the publicly listed holding company of the USU Group) will invest in the new entity. USU’s Digital Consulting services are not part of the acquisition and will remain a member of the USU Group.

Benjamin Strehl, currently managing director of USU Software AG, will become CEO of USU Product. Bernhard Oberschmidt, CEO of USU Software AG, will join the board of directors of USU Product.

Our Analysis

At first glance, this appears to be a consolidation in the ITAM and wider IT Management Tools market with Thoma Bravo now effectively owning Snow, Flexera, and USU. This is a formidable grouping and well positioned to compete with ServiceNow and other IT Management tool providers.

However, USU Product will remain headquartered in Germany and will be run by USU senior executives. Thoma Bravo’s investment approach is somewhat ‘hands off,’ certainly compared to activist investors such as Elliott. As with all VCs, they seek operational efficiencies and enable their firms to grow both organically and via acquisition of complementary technologies. For example, in Flexera’s case, they provided the investment to enable the 2023 Snow acquisition.

Thoma Bravo is also no stranger to the world of IT Asset Management, having previously owned Flexera in 2011. Other companies in its current portfolio include: Imprivata, SailPoint, Sophos, and Ping Identity in the cybersecurity space, and the Coupa, Qlik, and SolarWinds applications.

The acquisition notes that USU Software AG & Thoma Bravo will invest jointly in USU Product to accelerate its growth. In recent years, USU has made big improvements to its ITAM tools portfolio so I would expect growth to come from branching out worldwide from its strong DACH base.

What or Who Next?

As noted above, a common growth strategy for Thoma Bravo companies is via acquisition of complementary technologies. In the case of USU, it has one of the broadest offerings in ITAM so I don’t foresee the need for acquisitions in our market. That’s not the case for their ITSM & ITOM products – a sector dominated by ServiceNow and BMC Remedy. Customers shouldn’t see any changes in their relationship with USU as the company remains headquartered in Germany with the same management team as before.

Looking beyond the specifics of this acquisition, it’s encouraging to see that investors see the value of ITAM. I have noticed an increase in investor enquiries particularly with regard to SaaS Management and FinOps tooling so it’s very much a case of “watch this space”.