Ofcom shakes fist at cloud (refers cloud to the CMA)

Ofcom refers cloud industry to the CMA

Ofcom, the UK communications regulator, has officially referred “the public cloud infrastructure services market” to the Competition and Markets Authority (CMA).

This comes after its probe into the UK cloud services industry. The market study has identified features that make it more difficult for UK businesses to switch and use multiple cloud suppliers. Ofcom particularly called out its concerns over the position of the market leaders Amazon and Microsoft.

The move has been under consideration since April 2023 when Ofcom first released its interim findings of an earlier September 2022 investigation into the inner workings of the UK public cloud market. At that point it revealed it was consulting on whether or not to refer the market over to the CMA for further investigation. Today’s announcement clearly shows it felt there was enough of a concern to warrant the referral to the CMA.

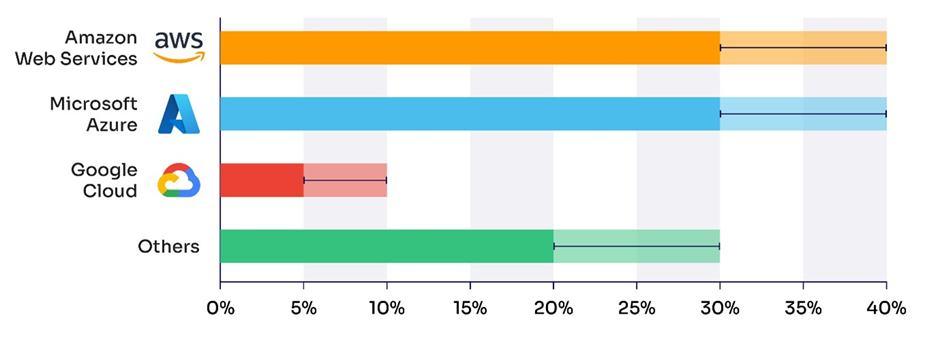

AWS and Microsoft dominate the UK cloud market

Ofcom’s report highlighted that Amazon Web Services (AWS) and Microsoft are the two leading cloud providers in the UK by some considerable margin, with a combined market share of 70-80% in 2022. Google is their closest competitor with a share of 5-10%.

Collectively these firms are known as the ‘hyperscalers’ and the vast majority of cloud customers use their services in some form.

Ofcom’s concerns

The following is an extract from the Ofcom report:

While competitive market forces are delivering benefits to customers – especially where providers are competing to attract new customers – in the form of innovative products and discounts, the features we are most concerned about are:

- Egress fees. These are the charges that customers pay to transfer their data out of a cloud and the hyperscalers set them at significantly higher rates than other providers. The cost of egress fees can discourage customers from using services from more than one cloud provider or to switch to an alternative provider.

- Technical barriers to interoperability and portability. These can result in customers needing to put additional effort into reconfiguring their data and applications so they can work on different clouds. This makes it more difficult to combine different services across cloud providers or to change provider.

- Committed spend discounts. These can benefit customers by reducing their costs, but the way these discounts are structured can incentivise customers to use a single hyperscaler for all or most of their cloud needs, even when better quality alternatives are available.

These market features can make it challenging for some customers to switch or use multiple cloud providers. This can make it difficult to bargain for a good deal with their provider, or to mix and match the best quality services across different providers. High levels of profitability for the market leaders AWS and Microsoft indicate there are limits to the overall level of competition

ITAM Review Analysis

Referring the UK cloud industry to the CMA feels like the right call. Many businesses and large swathes of the UK public sector rely on cloud services, so healthy competition is essential. When your choice is between two largely similar products with similar prices, you don’t really have much choice at all.

While Amazon and Microsoft (and other cloud providers) have made a range of technologies available to organisations who would otherwise have been unable to access them, it is important that these technological superpowers are not left unchecked for too long. While stifling advances in technology isn’t the desired outcome of this process, making it easier and cheaper for organizations to move to where they want to be is needed.

Cloud exit has long been a concern… it’s cheap and easy to get into the cloud but often expensive and difficult to leave. This imbalance can weaken customers’ negotiating positions with the cloud vendors – knowing that organisations are not truly free to swap to another supplier may mean prices are higher than they otherwise would be.

This investigation will hopefully help to ensure a free, fair, and flexible cloud market for all involved.

Will Google deliver the competition we need? Or Oracle? Oh the irony…

The dominance of AWS and Microsoft is something we have reported on a number of times (see AWS and Microsoft under fire for anti-competitive cloud practices). It is worth remembering that Google has been investing heavily to grow its distant 3rd place position, having achieved profitability for the first time earlier this year – the first time in 15 years! Could Google build on its position to introduce the competition the sector so sorely needs?

In our article at the time we reported:

The big news here is that Google Cloud is finally profitable! Sales of $7.4 billion saw a profit of $191 million. While that’s only 2.5%, it is the first time in 15 years that this part of Google has been in the black – it has lost over $14 billion in just the last few years alone. Whether they can sustain this move to profitability is the next question but, for customers of Google Cloud, this perhaps offers a little more certainty around the future of this product area. It perhaps also means that Oracle will have to fight even harder to grab that #3 cloud hyperscaler spot.

However, Google have announced an increase for some of their Data Egress fees from February 2024 – more details here – so perhaps it will be Oracle and their Cloud Infrastructure that takes the mantle of cloud saviour?!

Can’t find what you’re looking for?

More from ITAM News & Analysis

-

83% of IT Managers Believe their Asset Data is Highly Accurate - Only 35% of the Business Agrees

New and interesting research from WanAware hits at the nub of the disconnect many IT Asset Managers might feel about the value they deliver. The ‘Closing the ITAM Confidence Gap. 2025 Survey Insights for IT Leaders’ ... -

Microsoft Q4: Cloud and AI Results Drive Record Revenue

On 30th July 2025, Microsoft released its much-anticipated FY25 Q4 earnings report. The results follow a surprisingly strong Q3, which exceeded the expectations of some of the most optimistic investors. The latest Q4 results continue with ... -

10 Strategic Lessons for Tackling Compliance, Audits, and Software Licensing Risk in 2025

The ITAM Forum’s 2025 global ITAM research report in partnership with Azul reveals some fascinating insights into the financial, operational, and compliance risks involved in software licensing and audits. This article provides a high-level overview of ...

Podcast

ITAM training

Similar Posts

-

83% of IT Managers Believe their Asset Data is Highly Accurate - Only 35% of the Business Agrees

New and interesting research from WanAware hits at the nub of the disconnect many IT Asset Managers might feel about the value they deliver. The ‘Closing the ITAM Confidence Gap. 2025 Survey Insights for IT Leaders’ ... -

Microsoft Q4: Cloud and AI Results Drive Record Revenue

On 30th July 2025, Microsoft released its much-anticipated FY25 Q4 earnings report. The results follow a surprisingly strong Q3, which exceeded the expectations of some of the most optimistic investors. The latest Q4 results continue with ... -

10 Strategic Lessons for Tackling Compliance, Audits, and Software Licensing Risk in 2025

The ITAM Forum’s 2025 global ITAM research report in partnership with Azul reveals some fascinating insights into the financial, operational, and compliance risks involved in software licensing and audits. This article provides a high-level overview of ... -

Broadcom vs Siemens AG - A Brewing Storm

The ongoing legal battle between VMware (under Broadcom ownership) and Siemens is yet another example of why ITAM goes far beyond license compliance and SAM. What might, at first glance, appear to be a licensing dispute, ...