How do you convince the CFO?

Stop the CFO from wanting to show you the exit

As an IT asset management consultant, I’m in this business because I want to be remembered for making a difference. But ‘making a difference’ can mean different things to different people.

For the CFO for example, making a difference generally means one of two things – helping them to reduce their budgets while reducing risks to the business. While the former will typically result in nothing more than a pat on the back, the latter can secure a much more lasting relationship by repositioning SAM/ITAM as a partner to the business.

We spend too much time trying to convince the CFO that the single project we delivered resulted in bankable savings to the business, when we’d be better demonstrating the long-term value that we deliver as risk management consultants.

We need the CFO to see us in a different light. Rather than simply saying “thanks, and goodbye” at the end of a project, we want them to say “thanks, and how can I keep you here to protect the business in the long term?” We can achieve this change in two ways; by demonstrating the bankable savings the project actually delivered, while also showing how we can reduce risks to the business in the long-term.

Bankable savings?

IT asset management consultants need to be remembered for delivering bankable savings and not simply avoiding or reducing costs. Yet you’d be forgiven for thinking that bankable savings and cost avoidance are one and the same; surely saving money in one area (i.e. by avoiding an unnecessary cost) frees up budget that could either be spent in another department or kept in the bank (i.e. a bankable saving).

CFOs judge the success of any activity by a profit and loss statement. They allocate budgets and aim to make a profit against every one. They therefore only tend to remember those people who deliver profits. Can we ever deliver profits? If we can’t, what is the equivalent value we can offer the CFO?

Take this common scenario; the CFO budgets $10m for the company’s annual software budget, but when the true-up comes along they employ us as consultants to handle it. After spending a considerable amount of time determining the truth about their software estate and implementing best practices, we find that they actually owe $14m. As a result the organisation is facing a $4m loss on their software budget. While our expertise and licensing knowledge is able to lower the cost of the true-up to $12m, resulting in savings of $2m for the company, the CFO is still ultimately facing a $2m loss against their original software budget. To them it is still a net loss.

Despite delivering savings of $2m we are still primarily remembered for delivering bad news and not bankable savings. The reality is that the original budget was too low in the first place and the consultant has just mitigated a $2m compliance risk for the company which if left unchecked could have quickly ballooned to a much more difficult figure to balance.

This typical example highlights the problem faced by ITAM consultants every day; they are judged against the original budget figure which they had no input in and have no control over. This results in the CIO and their ITAM team not receiving the full recognition they deserve for the value they have delivered to the business.

Protecting the business from financial shocks

If bankable savings aren’t enough to convince the CFO of our value, how about the protection we offer against financial shocks to their budgets? Taking the example above, ITAM delivered much more than savings to the CFO. It protected the company from a previously unknown financial risk. Just think what the financial cost could have been if the software shortfall had remained unchecked for another year. The CFO needs to understand this.

We need to sell ourselves to CFOs as a risk mitigation exercise: we can reduce the risk of unexpected shocks to your IT budget if you use us. With IT asset management in place, you will always be informed. You may not like what we find but at least you will know what you are dealing with. The alternative is that you will have no idea what costs lurk around the corner. CFOs then need to acknowledge this difference made at the end of the process.

We could align ourselves with other professional consultants that protect the business from unexpected costs, such as lawyers and accountants. The CFO happily invests in retained relationships with these professionals because he knows they protect the business from unexpected costs further down the line. Plus, their own fees are a cost that can be budgeted in advance. The cost of the lawyer and accountant can be predicted, whereas the unknown costs that they protect the company against cannot. It is the same with the ITAM consultant.

We should therefore position ourselves as a service that will protect a company’s budgets from unexpected losses. Yes, hiring an ITAM/SAM team is a cost, but it is one that can be budgeted for.

Let’s change our industry for the better!

As an industry we have to work hard to reposition ITAM and SAM as professional services with the same levels of importance and credibility as lawyers, accountants, tax professionals and just about any other consultant that the CFO turns to in the course of their day jobs. Proving how we can deliver both bankable savings and long-term financial risk protection is the best way to achieve this.

Can’t find what you’re looking for?

More from ITAM News & Analysis

-

Stop Shadow IT Before It Hurts Your Business

Shadow IT often spreads quietly and quickly becomes a serious risk. Just look at the UK-based supermarket chain Co-op. A little-known remote maintenance tool used by an external IT provider was compromised. The result? Nearly 800 ... -

Why ITAM Forum Should Join the Linux Foundation: My Rationale and Your Questions Answered

TLDR. ITAM Forum has the opportunity to join the Linux Foundation as a stand-alone, self-funded project. This article covers a) What’s happening b) Why I think it’s a great move for the ITAM Forum and c) ... -

Microsoft Pricing Changes: EA Customers Face Price Increases

From 1st November 2025, Microsoft will remove all tiered pricing for Online Services under the Enterprise Agreement. This means all customers renewing or purchasing new Online Services after this date, will receive standard level A pricing ...

Software Licensing Training

Similar Posts

-

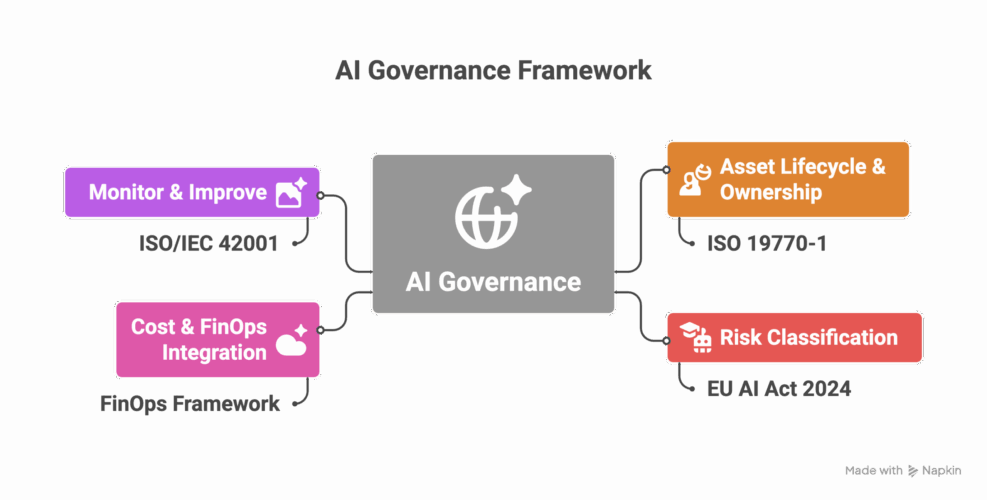

Eight steps towards AI governance

I delivered our “Managing AI as an Asset” training course the day before the Wisdom conference last week. Thank you to those who attended and provided feedback. It will be available on the LISA platform before ... -

Crawl, Walk, Run applied to ITAM Best Practice (Practical ITAM)

Since the ITAM Forum has been working in strategic partnership with the FinOps Foundation, I’ve come to admire the Crawl, Walk, Run approach to best practices, as it allows improvements and recommendations to meet the organisation ... -

Stop Shadow IT Before It Hurts Your Business

Shadow IT often spreads quietly and quickly becomes a serious risk. Just look at the UK-based supermarket chain Co-op. A little-known remote maintenance tool used by an external IT provider was compromised. The result? Nearly 800 ... -

AI Governance Through an ITAM Lens: Treat AI as a Status Change, Not a New Asset

Managing AI in the enterprise is a team sport. In this article, I want to explore specifically what ITAM brings to the table as we enter the AI era. As I’ve mentioned in previous articles on ...