Microsoft licensing - 10% price increases and programme changes

“Office 2019 pricing will increase by 10%”

Microsoft announced (June 25, 2018) licensing & pricing changes that will be introduced in the October 2018 price list. These will mean some actual price increases for a range of customers, primarily those in the mid-market space, and give a good indication of Microsoft’s future plans.

Programme changes

Consistent pricing

Microsoft are establishing a “single, consistent starting price” across all programs, aligned to web direct prices for online services. This means there is no more automatic price discount just for being on an Enterprise Agreement (EA) at Level A.

While the starting price will be the same between Enterprise Agreement & Web Direct, additional EA factors such as coverage and platform etc. will still lead to the Enterprise Agreement being able to offer lower pricing.

Removing programmatic volume discounts

For the Enterprise Agreement, the volume discount associated with purchasing at Level A (the entry level) will be removed. The level will continue to exist, but the volume discount associated with the level is being removed.

Coverage and platform discounts will still exist for EA Level A customers as will the ability to negotiate discounts.

There are no plans to change levels B-D as these serve “larger customers” with “complex requirements” that can’t yet be “fully support(ed) through…modern offers”.

For Open programs, Level C is being removed completely. From October 2018, there will be only “No Level”.

These changes are aimed at helping organisations purchase based on their needs, rather than price. It seems likely a big driver here is a move for more mid-market customers to purchase via CSP rather than small Enterprise Agreements.

Commercial price increases

At renewal, Level A MPSA, Select/SelectPlus and Enterprise Agreement customers will see prices rise by “less than 4%” while Level C Open License, Open Value and Open Value Subscription customers will see a rise of “around 2%”.

Government Pricing

Government pricing for web direct and CSP was aligned during 2017 and now the volume licensing programs are following suit. For the following agreements:

- Enterprise Agreement

- MPSA

- Select/Select Plus

- Open License/Open Value/Open Value Subscription

The government price will now align to the lowest commercial price in each program.

Government price increases

Most Government customers use Level D and they will see a price increase of 4-6% for Online Services. Government customers will also see Online Services prices increase by 3-18% via the Open & MPSA programs.

Software price will not be impacted by this programmatic change in EA, Select/Select Plus, and MPSA. However, Government customers in Open will see a phased implementation of the new pricing structure to help mitigate the impact of price increases, and the impact from the pricing alignment combined with the product price increase explained below will be capped at 20% or product price increase whichever is higher.

This programmatic change won’t affect academic or non-profit agreements “at this time”.

Other changes

There will also be changes to the Customer Price Sheet (CPS) which will give increased “pricing transparency” to EA/EAS customers.

Product changes

Office

Office 2019 pricing will increase by 10%. This will include Office client, Office server products and the Core/Enterprise CAL bundles across all commercial agreements and academic agreements, excluding the Enrolment for Education Solutions (EES) agreement.

What does the road ahead look like for on-premises Office 2019? Microsoft are positioning Office 365 Office ProPlus as the preferred option in most cases, and now that on-premises just got 10% more expensive, cloud is – hopefully for Microsoft – looking more attractive.

I’ve often said that Microsoft will probably make on-premises licensing less attractive, and a great way to do that is through removing certain key features. I’m not saying they’re going to do away with Excel, but they may well remove Roaming Rights – just as they did with Windows 10 in 2016. This Software Assurance benefit allows correctly licensed users to “remotely access their software on their virtual desktops from 3rd party devices”. For Windows, the removal of that SA benefit meant Windows 10 per User licensing was the only option for certain organisations, and the same would be the case for Office – where the “per User” option is Office 365 ProPlus.

It has already been announced that:

- Office 2019 will only run on Windows 10

- Office 2019 will only support Click2Run (C2R) installations

- Office 2019 will have a 7 (rather than 10) year support lifecycle, with three years being shaved off the Extended support phase.

- From October 2020, only Office in mainstream support will be able to connect to Office 365 services.

Windows Server

Windows Server 2019 Standard edition will see a 10% price increase while the RDS Device CAL will increase by 30%, bring its pricing in line with the User CAL. This again is aimed at making the per User licensing option more attractive.

Windows 10

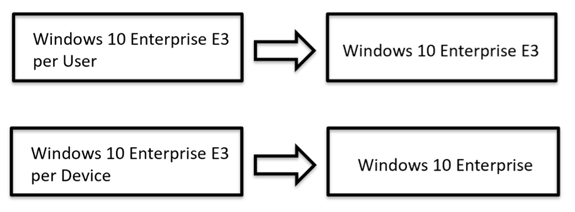

Windows 10 product names are changing slightly from October 2018, with the per User/Device suffixes being dropped and instead E3 will signify that it is per User.

As part of this shake up, Windows 10 Enterprise E5 per Device will be discontinued.

Pricing

The pricing of Windows 10 Enterprise will be raised to match the pricing of Windows 10 Enterprise E3, removing the individual license cost as a reason to remain licensed per device.

Modern Commerce

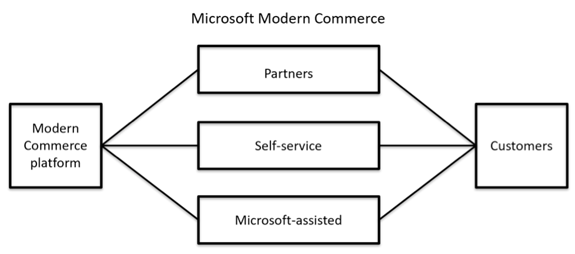

These are all steps on Microsoft’s “Modern Commerce Journey” – a process they have started to “better serve (their) customers”. The eventual goal is there will be a single “Modern Commerce” platform with customers being served through three distinct channels:

- Partners

- Self-service

- Microsoft-assisted

Microsoft’s aim, through aligning various aspects of their licensing estate, is to reduce inconsistency and confusion for customers and partners.

Conclusion

It’s been clear for some time that Microsoft wants as many of their customers in the cloud and licensed per user. Also, where it makes sense, there is a real preference for organisations to purchase through the Cloud Solution Provider (CSP) program. These recently announced changes all serve to move many organisations towards those options.

Small Enterprise Agreements can have a significant cost to Microsoft, particularly in terms of time, that isn’t always offset by revenues from the license sale. This was a factor in Microsoft’s raising of the entry level from 250 to 500 seats and I believe it is a factor again with this price levelling. Many organisations would stretch themselves to get a Level A EA just to get a cheaper price on Online Services – when it wasn’t really the right program for them. Now, those same organisations would be able to work with a CSP partner which benefits Microsoft threefold – not only does it remove the overhead of agreement creation and management, but it also means the customer should have a better engaged, more supportive experience AND it increases the likelihood they will end up using more Microsoft products/services long term.

Overall, these changes make it more difficult and more expensive for organisations to remain on-premises – although it can still be done. Those organisations that have made a choice to stay away from Office 365 may well find now is a good time to review that decision. For example, if it was because “on-premises still works” – is that worth an additional 10% on your Office bill, or would now be a good time to understand what would be needed to migrate to Office 365? You could offset some/all of the cost of the business transformation against the “saving” you’ve made by not being subject to the on-premises price increase.

Organisations that must remain on-premises should start talking to Microsoft ahead of their next EA renewal to understand how they will be affected and what, if anything, can be done to lessen the impact.

Further reading

https://blogs.partner.microsoft.com/mpn/announcing-price-adjustments/

https://www.microsoft.com/en-us/Licensing/campaigns/modern-commerce.aspx

Can’t find what you’re looking for?

More from ITAM News & Analysis

-

ITAMantics - April 2024

Welcome to the April 2024 edition of ITAMantics, our monthly news podcast where we discuss the biggest ITAM stories from the last month. George is joined this month by AJ Witt and Ryan Stefani. Stories tackled ... -

Broadcom is removing expired VMware licences from its portal - take action now!

Hot on the heels of Broadcom’s announcement of the end of perpetual licences for VMware it has given customers barely a week to download any keys for licenses from its portal with expired support. This is ... -

Who Loses When Broadcom Wins?

News of a new Broadcom deal rarely arrives with great fanfare. The November 2023 VMware acquisition provoked open worry online and in business circles, with many critics wondering whether the former Hewlett-Packard spinoff’s reputation would prove ...