Five Steps to Preserving Cashflow with effective SaaS Management

This article, a collaboration between AJ Witt, SaaS Management Analyst, The ITAM Review & Dusan Omercevic, Founder of Cleanshelf, provides practical advice on how managing SaaS expenditure can protect your organisation’s cashflow in a crisis such as the current pandemic. We’ve seen government schemes designed to cover wages on a short-term basis to prevent redundancies and layoffs but that doesn’t cover technology spending, and that’s where you can make a vital difference.

Why is cashflow important?

Many organisations, particularly those in retail, hospitality, and travel have seen their cashflow crash close to zero, almost overnight. Cash is the lifeblood of any company and this is reflected in the emergency stimulus packages launched by governments around the world. Without cash reserves and lines of credit, otherwise perfectly healthy businesses will fail when subjected to the sudden short-term fall in demand for their goods and services that they’re currently experiencing.

How can SaaS Management help cashflow?

The key thing about cashflow is that it’s a short term day-to-day, week-to-week, month-to-month measure of the health of a business. Therefore, any initiatives designed to preserve cashflow need to deliver results within a similar time frame. There’s little point in renegotiating next year’s Microsoft renewal or taking out an Oracle ULA to reduce database costs if your business is going to run out of cash next month. This is where effective management of software subscriptions has a role to play in preserving cash. For some organisations, particularly those with a limited physical footprint, technology spend will be second only to wages.

Most spending on Software-as-a-Service (SaaS) will be on a short timeframe – typically one month rolling contracts or annual contracts. By paying close attention to this spending you can immediately preserve cashflow in the short and medium term, vital to keeping your business alive. How do you go about it? We recommend a five-step plan.

1. Ban new subscription purchases

First up, you need to implement a blanket ban on new software purchases. At our recent Crisis Management summit it was suggested that this ban should be enforced with an end to reimbursing software purchased via personal expenses. This will be challenging, and you will need to recruit stakeholders in HR & Finance to ensure it is fully implemented. Critically, at this stage, you don’t need data or a SaaS Management tool to get that implemented. HR & Finance are good at such blunt measures – recruit them to your cause. Anyone working in a large corporate will be familiar with such policy changes – travel bans, restrictions on overnight stays, and so on.

2. Take control of renewals

With expenditure restrictions in place you’ve ensured that the problem doesn’t get worse. Step 2 is to get a grip on your renewals. With organisations typically using hundreds of SaaS apps your weekly renewals activity is like a conveyor belt crammed with items. It’s different to perpetual software renewals where the timeframe was at a minimum yearly and often three-yearly. You need to temporarily halt that conveyor belt and take some time to inspect everything on the line. Things to check are;

- What is this renewal for?

- How long is the commitment?

- What’s the metric?

- How many licenses do we need to meet current demand?

- Is it set to auto-renew?

If you haven’t already started your SaaS Management programme you may find it difficult to find out what’s being renewed and when. Once again, Finance, and specifically the Accounts Payable department, are your key stakeholder. You should also work with whichever department is responsible for reimbursing personal expenses. These stakeholders should be able to identify software spend. You’ll need to ask them to look at what was being paid 12 months ago as well as last month as this will capture subscriptions on monthly and annual renewal cycles. It’s likely that it will take you more than one monthly billing cycle to get to grips with renewals so it’s important that you also look ahead 3-4 months for services on annual renewals. By doing so you can get ahead of the renewal curve and buy enough time to make the any changes necessary to reduce consumption and cost.

3. Assign business owners

Steps 1 and 2 have got you to the point where you’ve stopped new commitments to spend cash that you potentially don’t have. The next step is to look at the business value of the software subscription. To do this you’ll need to identify the business owner. Once again, Finance will be able to help you with this.

A good starting point for identifying owners is finding out who authorised payment of the invoice and Finance will have that information. This is important because payment for subscription software may come out of departmental budgets rather than through central IT. For mature organisations the Service Catalogue will also be a source of valuable information as this will highlight the interdependencies between subscriptions and business processes. If a SaaS subscription underpins a critical business process clearly it needs to be retained.

We recommend that in Step 3 all SaaS spending is categorised into three buckets

- Optimise Immediately – remove these subscriptions as soon as possible

- Down-size if required – remove these if the cashflow situation becomes critical

- Essential – never remove these unless an equivalent cheaper alternative can be sourced that doesn’t impact critical processes

These decisions should be made by the business owner as they are best placed to understand the value of the application to your organisation. For contracts with significant expenditure you may also wish to seek re-approval of the spend, leveraging the reduction in individual spending and authority limits often imposed during challenging business conditions.

4. Deprovision Licenses

So far, we’ve got to the stage where new spending has been curtailed, renewals are under control, and we have an idea of the value of individual subscriptions to your organisation. It is now possible to move on to the next phase – the deprovisioning of unused software subscriptions. Your key stakeholders here are HR & User Account Management. HR will have data on workers who have been laid off, made redundant, or furloughed. User Account Management teams may have data showing, for example, last logon date for a user which can be used to validate the data from HR. The output will be a definitive list of all users who have left your organisation which then can be used to deprovision unused accounts. Deprovisioned monthly subscriptions immediately reduce unnecessary drain on your cashflow. For yearly or longer subscriptions, the deprovisioned license may be allocated to any new requests for that software submitted in the interim. Then, at renewal time, the number of subscriptions can be reduced to take account of your new requirements.

5. Negotiate concessions and manage consumption

The final action to take to protect your cashflow is something that can be done alongside the other steps. Start talking to your key SaaS vendors about your requirements. As a result of the pandemic many SaaS companies are struggling with reduced vertical and horizontal demand for their products. If you sell solutions designed for a vertical such as Hospitality your demand will have fallen directly as your customers in many cases cease or pause trading. Similarly, if you sell horizontally across industries – e.g. project management software – you will also be affected by the general economic downturn and reduction in employee numbers. SaaS vendors are particularly susceptible to rapidly falling demand like this because of the per-user short-term licensing model they usually employ.

SaaS vendors live and die by their user and usage numbers and are terrified of churn (the proportion of users leaving their service per month). This means they will do almost anything to retain you as a customer. Honest conversations between your procurement teams and the vendor will yield concessions to help you preserve cashflow until the crisis is over. These could include: payment holidays, free extra months, and “true-downs” that are often not possible in yearly or multi-year contracts.

Additionally, there are many services that don’t use the per-user metric. Docusign, for example, uses number of signed envelopes. Other common metrics include storage and API usage. Marketing platform Marketo uses contact database size, and Mailchimp uses list size as a metric. Whilst this article is covers SaaS, now is also the time to look at your consumption of Infrastructure-as-a-Service with services such as Amazon AWS & Microsoft Azure. Options there include moving non-critical workloads to spot instances, and critical workloads to reserved instances. For more on this, see this article and our content collection for IaaS

Summary

This article has outlined a five-step approach to ensuring unmanaged SaaS spend doesn’t erode your cash flow. The steps are:

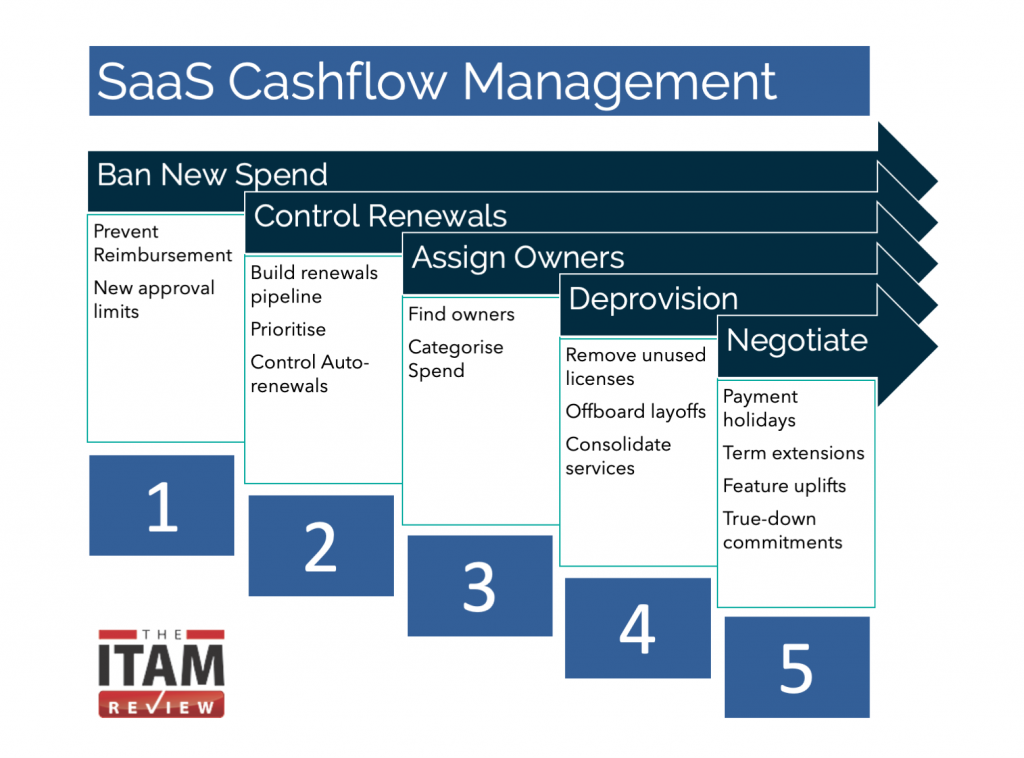

Fig 1: Steps to reduce expenditure on SaaS and preserve cashflow

-

-

- Block new SaaS purchases

- Control renewals

- Assign Application Owners & categorise importance of SaaS subscriptions

- Deprovision licenses

- Negotiate concessions for per user and consumption-based subscriptions.

-

The best approach to doing this quickly will be to engage with stakeholders in Finance & HR as they will have both the data and the necessary standing within your organisation to make rapid policy changes that stick. If you currently report within the IT organisation this is an opportunity to broaden your remit, engage new stakeholders, and do the best you can to protect your organisation’s cashflow.

For more on this subject please see Cleanshelf’s presentation at our recent Online Summit (available on demand here) or their whitepaper, available here (registration required).

Can’t find what you’re looking for?

More from ITAM News & Analysis

-

Software Vendor Insights: What do the numbers tell us about the opportunities for ITAM negotiations?

What software vendor insights can be gained from the latest financial results from Amazon, Google, Broadcom, Salesforce, IBM and SAP? An important part of ITAM is paying close attention to the health of the companies we ... -

Flexera is first SAM tool vendor verified for Oracle E-Business Suite applications

Flexera has announced that it has been verified as the first software asset management (SAM) tool vendor for Oracle E-Business Suite applications. Almost anyone with an Oracle estate will be familiar with the company’s License Management ... -

ITAMantics - March 2024

Welcome to the March 2024 edition of ITAMantics, where George, Rich and Ryan discuss the month’s ITAM news. Up for discussion this month are. Listen to the full ITAMantics podcast above or queue it up from ...