Enterprise SaaS Management goes mainstream in Gartner's 2020 SAM Magic Quadrant

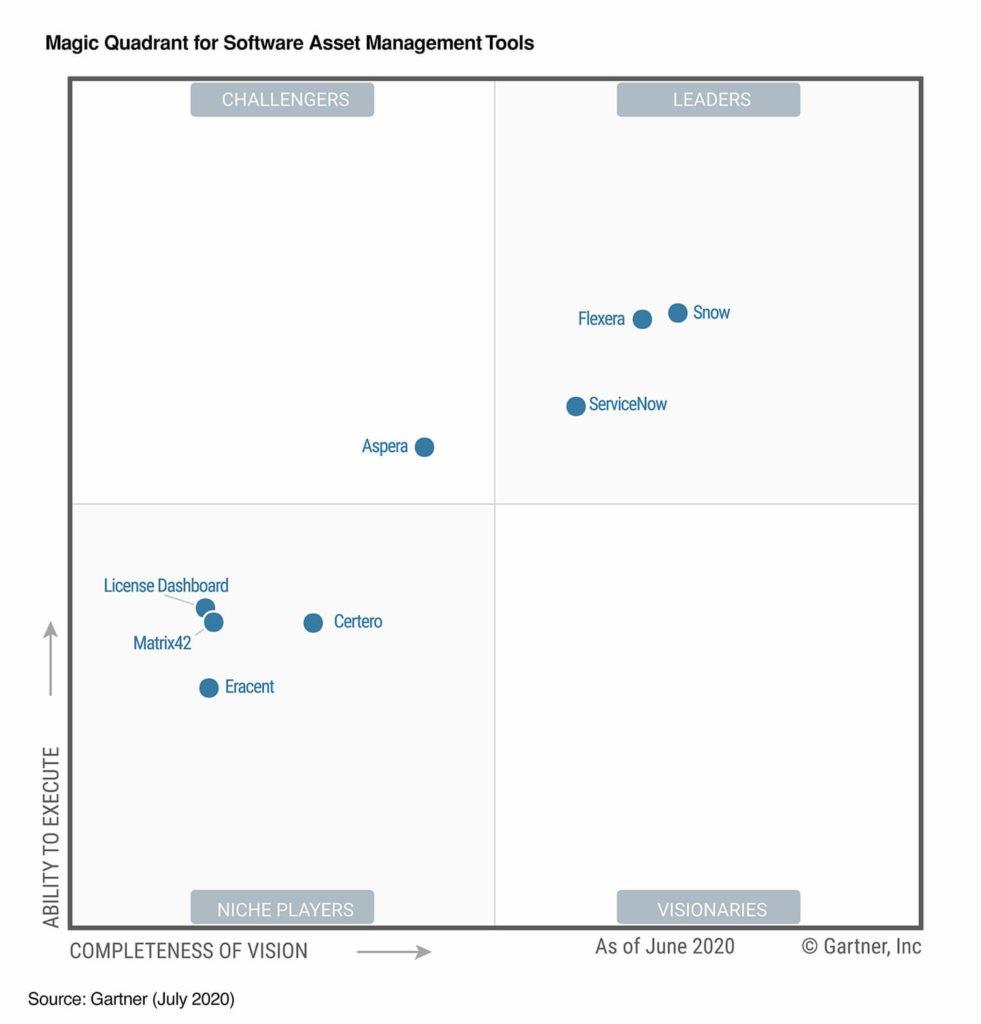

Gartner’s 2020 Magic Quadrant (MQ) for SAM Tools was released in July. For this year’s edition, under new authorship by ITAM industry veteran Ryan Stefani, we’ve seen three vendors added, three removed, and three of the 8 participants placed in the leadership category.

The full Magic Quadrant report is available from Gartner (subscription required) while Aspera, Flexera, ServiceNow, and Snow all have copies available for download (registration required).

What’s changed in the 2020 Magic Quadrant?

New entrants this year are Certero, License Dashboard, and Matrix42. In my analysis of last year’s MQ I highlighted these as vendors likely to meet Gartner’s criteria.

On the flipside, 1E, Belarc, and Ivanti are not included in the quadrant this year. Their exclusion is solely due to not meeting Gartner’s revised inclusion criteria – more on this below. Gartner also note that the market is growing – up 12% in 2019 to around $300m1.

My view

Enterprise SaaS Management

The big movement in the quadrant this year is as a result of Gartner seeing the importance of Enterprise SaaS Management for SAM teams. In order to be included in the SAM MQ Gartner required tools to provide native API integration for SaaS services offered by one of Adobe, Microsoft, and Salesforce. API integration with SaaS vendor portals is critical in providing enterprise-scale management of SaaS subscriptions. Over the past three years we’ve seen existing SAM tool vendors developing or acquiring Enterprise SaaS Management capabilities and this report will no doubt accelerate this trend. What remains to be seen is whether the best approach for tool vendors is to build that functionality into the existing toolset or to partner (as License Dashboard do with Binadox).

Where’s IaaS?

Whilst SaaS is front-and-centre in this year’s report the same can’t be said for IaaS. There is very little reference to managing your software deployments in Amazon AWS, Microsoft Azure, Google GCP, or even Oracle Cloud. This may well be because Gartner also create a Magic Quadrant for Cloud Management Platforms, including vendors such as Rightscale (acquired by Flexera) and Embotics (acquired by Snow).

What this comes down to is where you draw the line as a SAM tool provider. Are you a generalist working across deployment scenarios and lifecycle stages? Are you a niche player focusing on being the best at managing on-premises datacentres? Or are you a pure-play Enterprise SaaS Management vendor?

The importance of integration

Continuing this theme, the key for modern SAM tool vendors is to recognise that customers will take a multi-layered approach to managing their software assets. Rather than own the whole pie, make sure you’re providing the best possible ingredients and the ability to mix them together. Long term market participants such as Eracent, License Dashboard, and Aspera have blazed the trail in integrating discovery and inventory sources from other domains such as IT Operations & IT Security. Gartner note that SAM tools should “consume and produce information for use in other domains” and I look forward to products that provide rich API connections for ITSM/ITOM/FinOps/Enterprise SaaS Management toolsets. As a customer I need to be able to provide my senior stakeholders with an aggregated view of the entire software estate, and that’s what I would expect from a modern SAM toolset. Such two-way API connections support vital operational stakeholders such as Information Security and are also part of the reference design for an ITAM system according to NIST.

So, should I just look at the Leaders?

My final take on the 2020 Magic Quadrant is a note of caution. Magic Quadrants aren’t just about functionality and tool capabilities, there’s a whole bunch of other criteria that determine which part of the quadrant a tool is listed in. In some cases, the position is changed by marketing strategy and company size. For example, Aspera are listed as a Challenger, and the primary reason is that Gartner see them as focusing on License Compliance in their marketing messages, rather than hot topics of data aggregation and cloud consumption management. Aspera have very strong capabilities in these areas – data aggregation is absolutely core to their entire SAM offering – but Gartner don’t feel that they’re marketing them. As with everything in the SAM world it’s important to check the details. All the vendors included in this report offer strong SAM tools and you should assess each of them against your requirements, rather than just focusing on the leadership quadrant. That’s not to devalue the tool providers listed there but ultimately, it’s most important to focus on what’s key to your use case.

1 Gartner’s “Market Share Analysis: ITOM, Experience Management, Worldwide, 2019” analyzes market share for ITOM experience management, which includes SAM, ITAM and ITFM.

Can’t find what you’re looking for?

More from ITAM News & Analysis

-

ITAMantics - April 2024

Welcome to the April 2024 edition of ITAMantics, our monthly news podcast where we discuss the biggest ITAM stories from the last month. George is joined this month by AJ Witt and Ryan Stefani. Stories tackled ... -

Broadcom is removing expired VMware licences from its portal - take action now!

Hot on the heels of Broadcom’s announcement of the end of perpetual licences for VMware it has given customers barely a week to download any keys for licenses from its portal with expired support. This is ... -

Who Loses When Broadcom Wins?

News of a new Broadcom deal rarely arrives with great fanfare. The November 2023 VMware acquisition provoked open worry online and in business circles, with many critics wondering whether the former Hewlett-Packard spinoff’s reputation would prove ...