Google Cloud loses $5.6 billion

Software vendor financial results can be more interesting for ITAM & SAM managers than they might first appear. Looking at how the software vendors are performing on a quarterly and annual basis can give the savvy ITAM professional some good insights. Who is likely to increase audits? Where might good discounts be found? What upcoming business model changes might impact us? Hints to potential answers for questions like this, and more, can be answered by taking a look at the vendor’s results.

In this article we look at the most recent results for:

For more in-depth analysis on these vendors, check out the recording of our recent Online Summit here.

Amazon AWS

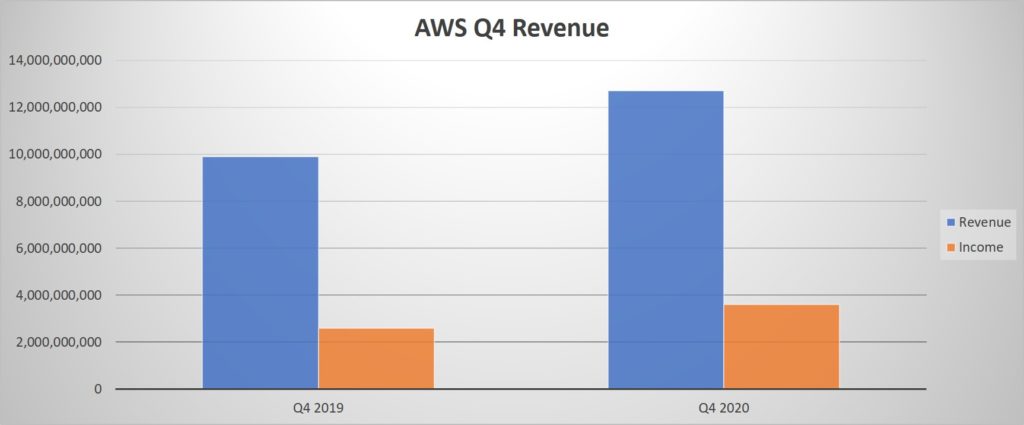

In some of the least surprising news for a while, Amazon AWS has had another successful year. Q4 revenue was up 28% to $12.7 billion with income rising 38% to $3.6 billion:

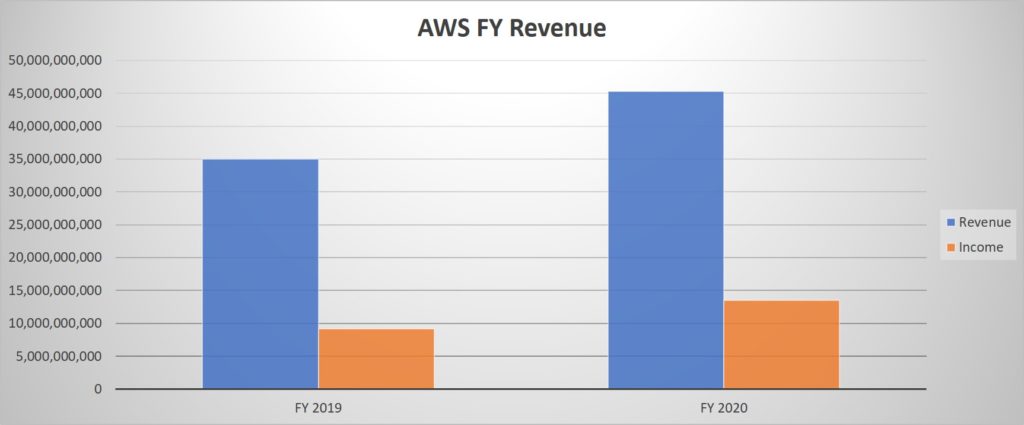

While the full financial year saw revenue increase 29% to $45.3 billion, with income up 47% to $13.5 billion:

Amazon are continuing to expand their presence with new regions and availability zones planned around the globe – including India, Australia, Spain, and Indonesia – in FY22.

The big news is that Jeff Bezos is planning to step down as CEO in Q3 2021 and his replacement will be Andy Jassy, the current head of AWS. Although Bezos isn’t going far – he’ll still be chairman of the board – any big leadership shift has the potential to set off a wave of changes across an organisation.

Further Reading

Google Cloud

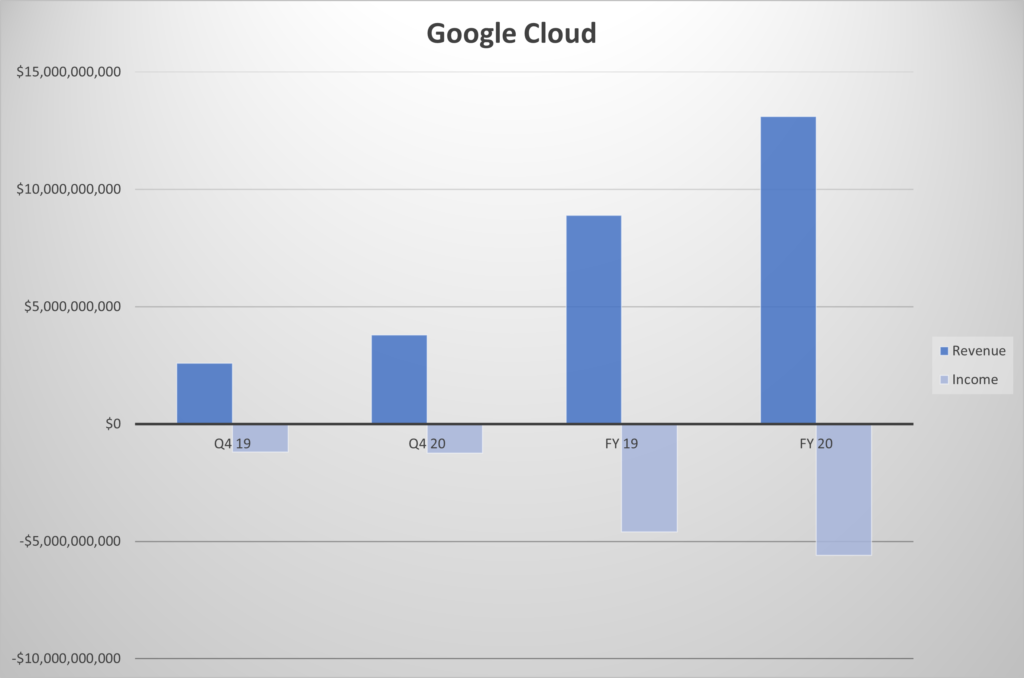

Revenue for Q4 was up 46% to $3.8 billion and for the full financial year it reached $13.1 billion, an increase of 47%. Excellent numbers but when you take a look at income, the picture starts to look a little different…Q4 2020 saw a loss of $1.24 billion with an overall loss of $5.6 billion for the financial year:

Google Cloud, which includes both Google Workspace (formerly G-Suite) and Google Cloud Platform (GCP) lost money in 2018 and 2019 too. While revenue continues to increase, the losses have grown too, with a jump of $1 billion from 2019 to 2020 as Google Cloud loses $5.6 billion in total for the year.

Google are really working to position themselves as the #3 public cloud offering (behind Amazon & Microsoft) and have been doing quite a good job, but might this give customers pause for thought? Especially with Google’s track record for shuttering products, I can imagine some might think twice before signing up! Oracle are making a big play on cloud too – perhaps they’ll try and use this to their advantage to advance their own cloud aspirations?

Further Reading

IBM

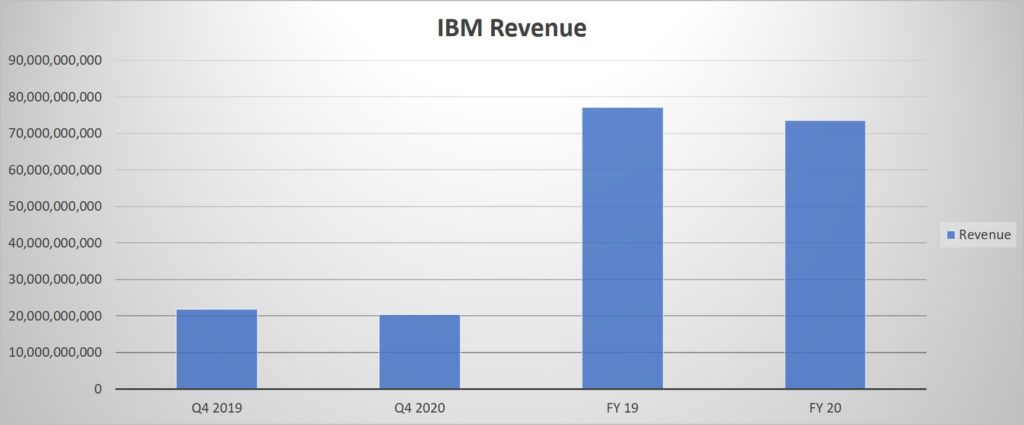

Q4 for IBM saw overall revenue of $20.4 billion – a decrease of 6% – but, within that, cloud revenue was up 10% to $7.5 billion. Continuing the babushka doll theme, revenue specifically for Red Hat was up 19% – although there’s no dollar amount listed for that section.

For the full year, overall revenue was down 5% to $73.6 billion but, just as we saw in Q4, cloud revenue is looking much healthier with cloud revenue up 19% to $25.1 billion and Red Hat revenue up 18%.

It’s clear where IBM see their future with a spate of acquisitions focused on cloud and AI and the upcoming spin-off of their Managed Infrastructure Services business into NewCo. With this, and other changes such as increasing on-premises prices, evaluate your IBM portfolio and consider where you might experience pain points in the upcoming years.

Further Reading

Micro Focus

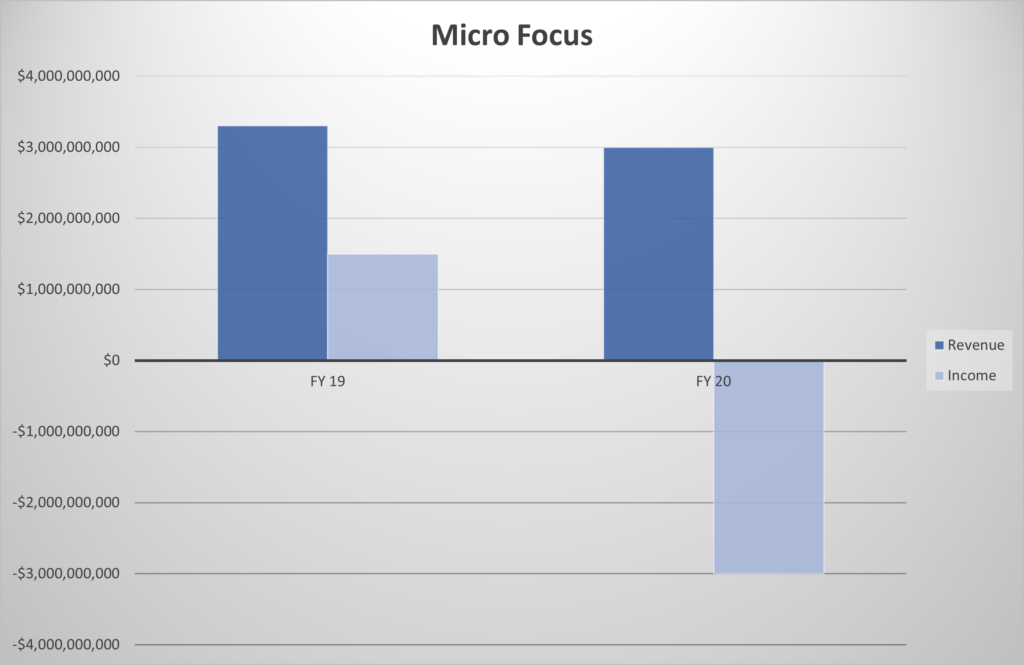

For Micro Focus, the financial year ended in October 2020, but the results have only recently been announced. They had annual revenue of $3 billion, a 10% drop, and – in terms of income – made a $3 billion loss for the financial year…although $2.8 billion of that was an “impairment charge” where they wrote down a large chunk of the ill-fated HPe purchase from 2017. They made a profit of $1.5 billion in 2019 so, even without the write down, 2020 still represented a large drop in profit.

License revenue has dropped significantly – down 19% from $799.2 million to $646.5 million. Micro Focus have identified a switch to SaaS and subscription as the way forward and, in certain product areas, will be “leading” with these option in FY21 (this current year) and then making those the only options from FY22 onward. This represents an area of risk as it’s likely Micro Focus will see audits as a great way to identify non-compliance that they can then turn into ongoing subscription revenue; however, there is opportunity too as it gives a good reason to take stock of your Micro Focus exposure and take action to limit it.

Further Reading

Microsoft

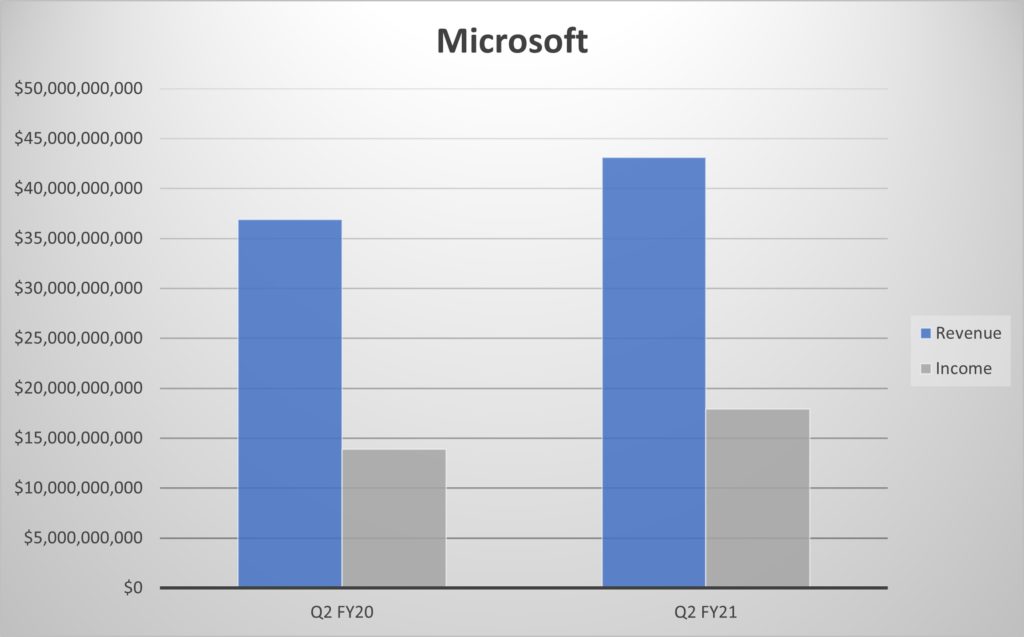

Unlike the other vendors examined in this article, Microsoft are at the midway point of their financial year and, as expected, the second quarter yielded good results. Revenue was up 17% to $43.1 billion with operating income up 29% to $17.9 billion:

- Office 365 Commercial rose 21% and Dynamics 365 was 39% up

- Microsoft Azure growth was 50% – continuing to close the gap on Amazon AWS

- Office Commercial (on-premises Office) was down 26% as organisations continue to shift across to Office/Microsoft 365 – although the on-premises Server products area saw growth of 4%

- Windows OEM Pro revenue dropped 9% while non-Pro rose 24%, although overall there was just a 1% increase in Windows OEM revenue

Things are looking positive for Microsoft with organisations continuing to spend in the focus areas – Microsoft 365, Azure, and Dynamics as well as LinkedIn, Xbox, and Surface too. For those of you with Microsoft anniversaries/renewals in their Q4 (April/May/June), now is prime time to be preparing for those negotiations and orders. The info above can help give you an idea of where to focus and what to ask for.

Further Reading

SAP

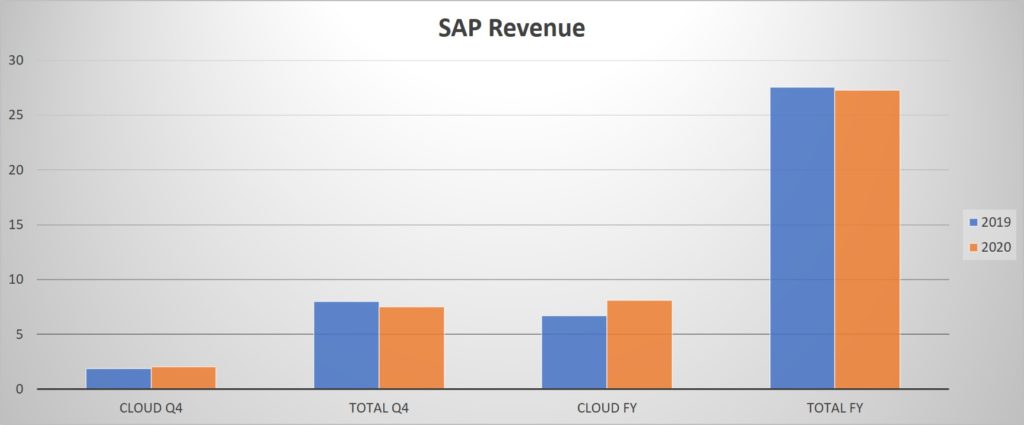

SAP’s Q4 2020 saw total revenue drop 6% to €7.53 billion while cloud revenue increased 8% to €2.04 billion. For the full financial year, total revenue was €27.3 billion – just 1% down year on year – and cloud revenue was €8.08 billion, a rise of 17%.

Even though a 1% drop in revenue is a decent showing for SAP at the moment, software license revenue was down 20% which will likely further drive the focus on migrating customers to S/4 HANA.

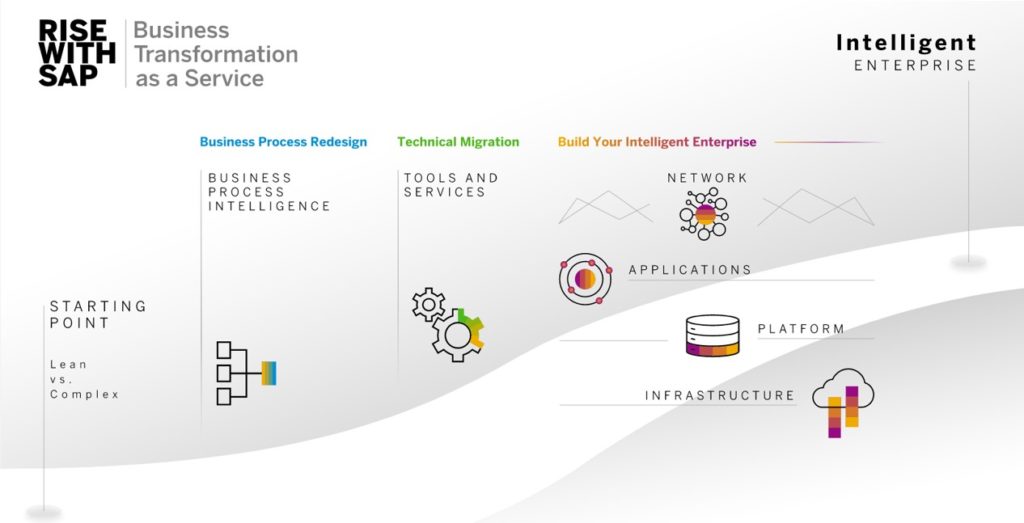

On that note, the “RISE with SAP” program is a new initiative aimed at easing that move to the S/4 HANA cloud, helping with various aspects of what is a large-scale digital transformation project:

https://www.sap.com/uk/products/rise.html

Be on the lookout for SAP coming to people within your organisation with this soon!

Further Reading

Summary

It’s no real surprise that cloud is, generally, the way forward – each company we’ve looked at here has made/is making cloud their focus for the future. Microsoft and Amazon AWS are clear successes, but the rest still have a lot of work to do – can Google make their cloud business profitable or will it be propped up by the ad business forever? For IBM, SAP, and Micro Focus – the struggle is real. Moving a solid on-premises business to cloud…and keeping your customer base…is difficult and needs a clear vision and a strong portfolio. Adobe and Microsoft prove that it can be done but it’s far from a guaranteed win and will require a lot of focus and energy from the software vendors.

Can’t find what you’re looking for?

More from ITAM News & Analysis

-

Adobe Sued by FTC for Unfair Selling Practices

The Federal Trade Commission has announced legal proceedings against Adobe and two of its senior executives for what it claims is misleading and complex terms and activities related to cancellation of software subscriptions. Section 8403 of ... -

CrowdStrike outage highlights the need for robust HAM and possible software diversity

Highlighting HAM Picture the scene. It’s Friday, and in the UK, at last, the final day of school for many children. Holidays booked and much needed time off from work stretches ahead of you. Except if ... -

Flexera 2024 State of ITAM Report is Here (Key Takeaways)

Hot off the Presses. Flexera has just released its 2024 State of ITAM report. For those unfamiliar, this is an annual research survey conducted by Flexera that examines the status of the ITAM industry. This year, they ...