Software vendor results & ITAM insights: Q1 2023 – including VMware, IBM and Salesforce annual reports

What are the most pertinent software vendor results from Q1 2023?

Each quarter we are going to give you an overview of the financial results of key software publishers – including the “Big 4” Tier 1 vendors. Numbers don’t lie, so they provide interesting insights into the company’s priorities, growth areas and pain points.

From an ITAM perspective they give us an indication as to which vendors are likely to increase audits, where good discounts could be found, what changing business models are on the horizon (pushing customers to the cloud for example) and plenty more. Having this information will also help you speak the same language as executives and business leaders as you work with your internal stakeholders.

Each roundup will look at the results from the previously published quarter, so in this instance we are looking at pertinent results from calendar year Q1 2023, the Jan-March time period. VMware, Salesforce and IBM published their annual reports during this period, so we’ve focused some time on them, in addition to some pertinent quarterly statements from Microsoft and Opentext (Micro Focus).

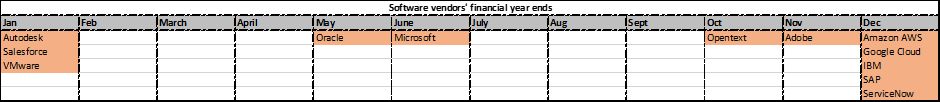

The following financials calendar shows where each of the vendors’ Year-Ends fall so you can get a sense of when we’ll do our big end-of-year analyses – reports are usually published a month or two after the end of the FY.

Here’s a chart showing the financial year-ends for each of these software vendors:

Annual reports this quarter

VMware annual report FY23 – SaaS revenue up 25% year-on-year!

Headline stats

- Total Revenue of $13.35 billion for the year (up 4%)

- FY23 Subscription and SaaS Revenue of $4.01 billion, an increase of 25% year-over-year (representing 30% of total company revenue)

- ESG recognition: VMware was recognized by the 2022 Dow Jones Sustainability Indices for the 3rd year in a row, ranking in the 99th percentile for all companies

Relevant comments

“We delivered strong performance to close out our fiscal year 2023, achieving over $13 billion in total revenue and $4 billion in subscription and SaaS revenue for the year,” said Zane Rowe, executive vice president and CFO, VMware. “We grew subscription and SaaS ARR 30% year-over-year, totaling $4.66 billion, an increase of over $1 billion in ARR for fiscal 2023, reflecting the strength of our subscription and SaaS portfolio and progress on our business model transition.”

ITAM Review analysis

VMware are growing their recurring business which is exactly what their potential new owners, Broadcom, want – along with a huge increase in EBIDTA over the next 3 years. Although the planned takeover is still being scrutinised by regulators – particularly in the UK (Decision to refer (publishing.service.gov.uk)), it’s likely that VMware are working towards those aims on the basis the acquisition is completed.

IBM annual report FY22 – revenue up 5.5% to $60.5 billion

Headline stats

- At constant currency, Software revenues up 12%, Consulting 15%, and Infrastructure up 14%

- $9.3 billion of free cash flow

- While revenue is up, net income is down 71.5%. From $5.7 billion to $1.6 billion

- 54% gross profit margin

Relevant comments

“In 2022 we took decisive steps to build a stronger IBM, executing against a sound strategy with speed, focus, and consistency. Our growth is accelerating, our confidence is growing, and our company is gaining momentum,” Arvind Krishna, chairman and CEO

“Our 2022 performance demonstrates that we are now a higher-growth, higher-value company with the ability to generate strong cash from operations and a growing free cash flow,” Page 9 in Annual report

ITAM Review analysis

The report reads like a company executing a turnaround, with lots of talk about how IBM is positioned to take advantage of the hybrid cloud and AI markets. Lots of talk about AI in their report (“AI is expected to unlock $16 trillion in value from the global economy by 2030”) which fits with the current trends and likely direction of many technology offerings.

It mustn’t be forgotten that IBM significantly raised many of their prices at the start of 2023 as well as making changes to their Passport Advantage agreement clauses. Both actions putting more risk and financial pressure on their customer base.

IBM Passport Advantage bombshell – The ITAM Review (itassetmanagement.net)

Salesforce annual report FY23 – Revenue up 18% to $31.4 Billion

Headline stats

- $31.4 billion in revenue split accordingly:

- Subscription and support revenues were $29.02 billion, up 18% Y/Y

- Professional services and other revenues were $2.33 billion, up 27% Y/Y

- Operating cash flow of $7.1B, up 19% Y/Y

Relevant comments

“For the full year we delivered $31.4 billion in revenue, up 18% year-over-year, or 22% in constant currency, one of the best performances of any enterprise software company our size,” said Marc Benioff Chair and CEO of Salesforce. “We closed FY23 with operating cash flow reaching $7.1 billion, up 19% year-over-year, the highest cash flow in our company’s history, and one of the highest cash flows of any enterprise software company our size.”

ITAM Review analysis

Salesforce are, as always, very upbeat and rightly so with double digit revenue increases and a very healthy cashflow. It puts them in a strong position to continue competing against the likes of Microsoft in the CRM and BI spaces.

Quarterly statements – in detail

Microsoft Q2 to 31 December 2023 (published 24th January 2023)

Headline stats

- Revenue in Productivity and Business Processes increased 7% (up 13% in constant currency) to $17.0 billion

- Office Commercial products and cloud services revenue increased 7% (up 14% in constant currency)

- Server products and cloud services revenue increased 20% (up 26% in constant currency) driven by Azure and other cloud services revenue growth of 31% (up 38% in constant currency)

Relevant comments

“We are focused on operational excellence as we continue to invest to drive growth. Microsoft Cloud revenue was $27.1 billion, up 22% (up 29% in constant currency) year-over-year as our commercial offerings continue to drive value for our customers,” said Amy Hood, executive vice president and chief financial officer of Microsoft.

ITAM Review analysis

Although all the key areas saw movement in the right direction, this was a relatively weak quarter for Microsoft with significant drops in the size of the increases. Whether this is a temporary wobble due to the macro-economic climate or the start of a sustained slowdown in growth remains to be seen.

Opentext Q2 to 31 December 2023 – published 2 February 2023

Headline stats

- Opentext closed its acquisition of Micro Focus 31 January 2023

- Cloud revenues of $409 million, up 12.0% Y/Y or up 16.0% in constant currency

- Eight consecutive quarters of cloud organic and ARR organic growth in constant currency

- GAAP-based net income of $258 million, up 192.7% Y/Y, margin of 28.8%, up 1,870 basis points Y/Y, including $172 million of pretax unrealized gains on mark-to-market valuations related to derivative transactions in connection with the Micro Focus acquisition

Relevant comments

“Customers are looking to gain the Information Advantage and we are excited to expand our offerings with Micro Focus products to include Cybersecurity, Application Automation and Modernization, AI & Analytics, and Digital Operations Management,” added Mr Barrenechea. “As one of the world’s largest software and cloud businesses, OpenText powers and protects information to elevate every person and every organization to be their best. We welcome Micro Focus customers, partners and employees to OpenText. We expect to have Micro Focus on our operating model within six full quarters or sooner.”

ITAM Review analysis

Their cloud revenue is relatively small at just over $400 million but is seeing strong growth. Micro Focus have been moving towards a SaaS model for the past couple of years so we expect this will continue and so bolster OpenText’s cloud business. As we’ve mentioned previously, publisher M&As often lead to a focus on audits so keeping an eye on future results for this org will be key.

Quarterly statements – in brief

Amazon Q4 to 31 December 2022 (published 2nd February 2023)

Headline: AWS sales increased 20% year-over-year to $21.4 billion

Google Q4 to 31December 2022 (published 2nd February 2023)

Headline: Google Cloud revenues jump 32% to $7.3 billion. Up from $5.5 billion year-on-year

Oracle Q3 to 28 February 2023 (published 9th March 2023)

Headline: Q3 Cloud Revenue (IaaS plus SaaS) up 45% to $4.1 billion

Adobe Q1 to 3 March 2023 (published 15th March 2023)

Headline: 9 percent year-over-year growth to $4.66 billion in first quarter

Autodesk Q4 to 31 January 2023

Headline: Q4 revenue up 9 percent to $1.32 billion (revenue for fiscal year revenue up 14% to $5.01 billion). * Annual report not yet published at the time of publication

Can’t find what you’re looking for?

More from ITAM News & Analysis

-

Adobe Sued by FTC for Unfair Selling Practices

The Federal Trade Commission has announced legal proceedings against Adobe and two of its senior executives for what it claims is misleading and complex terms and activities related to cancellation of software subscriptions. Section 8403 of ... -

CrowdStrike outage highlights the need for robust HAM and possible software diversity

Highlighting HAM Picture the scene. It’s Friday, and in the UK, at last, the final day of school for many children. Holidays booked and much needed time off from work stretches ahead of you. Except if ... -

Flexera 2024 State of ITAM Report is Here (Key Takeaways)

Hot off the Presses. Flexera has just released its 2024 State of ITAM report. For those unfamiliar, this is an annual research survey conducted by Flexera that examines the status of the ITAM industry. This year, they ...