ServiceNow Knowledge 19: Stay hungry, Stay Foolish

ServiceNow Knowledge 2019

20,000 attendees and 200 partners met in Las Vegas to gorge on all things ServiceNow for their annual “Knowledge 19” conference at the start of May.

Due to the sheer volume of IT pros at the conference, I would speculate that “Knowledge” has become the largest gathering of end user ITAM practitioners on the planet. There were over 10 ITAM specific sessions, and each one I attended was packed to the rafters with between 250-400 customers. Over 80% of conference sessions were customers sharing their experiences.

ServiceNow’s “SAM Pro” offering is said to be the fastest growing product within their platform, and anecdotally I heard customer numbers have tripled in the last year (an unconfirmed 100 to 300). Many software companies would take five years to accrue that volume of large enterprise customers, but with many large enterprises embracing ServiceNow for ITSM – ITAM is a relatively straightforward cross-sell.

ServiceNow CEO John Donahoe is having quite the impact and I witnessed considerable interest in their ITAM offering at Knowledge 19. Will they continue to innovate or will their predominant market position result in them becoming yet another software industry dinosaur?

Donahoe vs. Slootman CEO impact on share price (Source Google Finance NYSE: NOW)

Let the customers do the talking

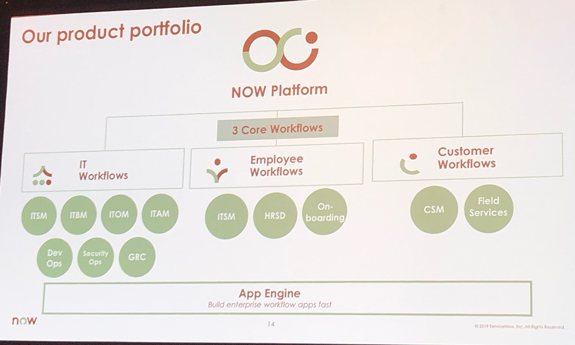

The theme presented by Donahoe was digitizing workflows. Building on the narrative introduced last year, the company wants to help their customers address complexity and make the “world of work, work better for people”.

At times I found the product demos awkward and cringeworthy. Carefully stage-managed announcements of new product releases with cute scenarios that seem to have been developed by someone nowhere near an enterprise IT environment. A sentiment echoed by customers on the show floor afterwards who said they “lost my attention”.

However, where I feel ServiceNow really comes into its own at events like these, its real strength, is when it shuts up and gets out of the way. When it lets the customers do the talking – industry leadership through customer execution. When it parks the cute demos trying to emulate an Apple launch and shows product making real impact in the enterprise.

Sessions with Virgin Trains, United Airlines, and Shell were fantastic examples of real-life digital transformation – radically improving the customer experience and automating the back-office plumbing of very complex organisations. All the while meeting governance goals and demonstrating transparency. Incredibly powerful stuff.

More real life digital transformation, less Apple launch, please

Installing an ITAM tool is not ITAM success

Mention ServiceNow’s ITAM capabilities to ITAM Review readers and they’ll claim it’s “not quite there yet” in terms of maturity compared to existing Enterprise SAM incumbents such as Aspera, Flexera and Snow.

But to write-off ServiceNow’s ITAM capabilities at this stage would be to miss some considerable momentum bubbling beneath the surface (and ignore the considerable interest in their technology at Knowledge):

- Firstly, whilst the product features might not be quite there, it must be said that the average maturity of ServiceNow SAM Pro customers (at least those I spoke to or saw at Knowledge) was low. So, they can buy into the long-term vision and the SAM Pro offering will be at full maturity when they have also matured. The roadmap is also moving along at breakneck speed, so I suspect the “apples to apples” comparison will be a moot point before long. Furthermore, success belongs to those who execute best, not those who have the shiniest tools.

- Secondly, and perhaps more importantly, is what ServiceNow were touting as their “Better Together” offering of ITAM integrated with ITSM and other key stakeholders. What is particularly impressive about this strategy is a) it reflects the future maturity of the ITAM industry, growing from an administrative function to an integral strategic governance function and b) nobody else in the large enterprise ITAM space can touch them here. Perhaps Ivanti, perhaps if BMC bought Flexera, but nobody on the horizon. But strong market dominance across ITAM and ITSM with weak competition breeds arrogance and bloated dinosaurs who forget about their customers. More on this later.

- Finally, ServiceNow can perhaps reach levels of seniority in IT organisations as yet untouched by the existing ITAM market.

What I liked about the ITAM roadmap is that it is not a bolt-on function; it’s integral to other parts of IT Operations. For example, a new app for end users to log incidents on their phone also included ITAM, a new app for the HR on-boarding process incorporates ITAM – all through one single database, login, and codebase. The Vendorhawk acquisition is being rolled into the main platform, a brave new world of grown up software development (As I’m someone who grew up in an industry where product integration strategy often didn’t extend far beyond the PowerPoint deck it was scribbled on).

Dave Wright, ServiceNow – Enterprise IT can not only catch-up, but eclipse the consumer experience

So far, so groovy in terms of competition and product strategy. ServiceNow’s challenge in the ITAM space, as I see it, will be in execution. They will undoubtedly be busy selling SAM Pro to existing ITSM customers for a while, the challenge will be swapping out the broader ITAM market and helping customers execute. A point reflected on the recent Gartner SAM quadrant, the key difference between ServiceNow and Snow and Flexera is not features, but ability to execute.

I’m yet to meet a large and established SAM practice that has swapped out their SAM toolset in favour of ServiceNow, reference customers are of low maturity, and partners in the exhibition hall lacked ITAM battle scars. Installing an ITAM tool is not ITAM success. Capabilities on the show floor didn’t match the level of interest in SAM sessions. A huge opportunity for SAM implementation partners, a bottleneck for ServiceNow.

A priority should be securing mature SAM lighthouse accounts and developing an implementation ecosystem.

Digitising IT workflows, employee workflows and customer workflows

Further ITSM/ITAM market consolidation anticipated / required

Who else in the large enterprise IT market is likely to take on this ITAM/ITSM combination?

A quick glance at both the 2019 SAM and 2018 ITSM Gartner Quadrants gives us some likely future partnerships and acquisitions.

- SAM 2019 Quadrant: 1E, Aspera, Belarc, Eracent, Flexera, Ivanti, ServiceNow, Snow Software.

- ITSM 2018 Quadrant: Axios Systems, BMC, CA Technologies, Cherwell Software, EasyVista, IBM, Ivanti, Micro Focus, ServiceNow

ITSM Companies with ITAM Capabilities

- Ivanti (Acquired Concorde 2017 Also HEAT, Enteo, Centennial Software, Absolute Software, RES etc)

ITSM Companies with possible ITAM capabilities

- Cherwell (bought Express Metrix in 2014 but are quiet on the ITAM front)

- EasyVista (Staff and Line ITAM heritage? Not sure about ITAM)

- Axios – ITOM focussed approach to ITAM, SAM capabilities unknown

- BMC – Discovery tool only and asset repository

Discounted

- CA (Sleeping dinosaur, unlikely threat)

- Microfocus and IBM – Aggressively audits customers (You wouldn’t buy gym equipment from McDonalds, why would you buy ITAM software from a company that audits customers for revenue generation?)

Using this logic, Flexera, Snow and Eracent could be acquisition targets for BMC – If indeed they want to compete with ServiceNow.

Dinosaur Watching

BMC Remedy used to be one of the world’s most popular request and ticketing systems. Somehow, they managed to take their eye off the ball and let ServiceNow eat their lunch. Will ServiceNow plot the same trajectory towards a bloated software dinosaur like many of its predecessors in the enterprise software market?

Firstly, let’s look at the characteristics of a software dinosaur:

- No innovation: Lost the ability to innovate, overuses buzzwords to clutch to relevance, PowerPoint based product strategy, snarking at competitors rather than creating clear blue water (distinct competitive differentiation).

- Abusive relationship with customers: Arrogance, exploits monopoly product position, has to force audits to generate income, shareholder value over customer outcomes

Whilst it’s too early to tell if ServiceNow will avoid the Dinosaur trap, they certainly seem to be staving off the usual Jurassic symptoms.

One more thing…

In the words of late Steve Jobs, whose product demos ServiceNow are trying to emulate, “stay hungry, stay foolish”, and please don’t become a software industry dinosaur.

Can’t find what you’re looking for?

More from ITAM News & Analysis

-

Software Vendor Insights: What do the numbers tell us about the opportunities for ITAM negotiations?

What software vendor insights can be gained from the latest financial results from Amazon, Google, Broadcom, Salesforce, IBM and SAP? An important part of ITAM is paying close attention to the health of the companies we ... -

Flexera is first SAM tool vendor verified for Oracle E-Business Suite applications

Flexera has announced that it has been verified as the first software asset management (SAM) tool vendor for Oracle E-Business Suite applications. Almost anyone with an Oracle estate will be familiar with the company’s License Management ... -

ITAMantics - March 2024

Welcome to the March 2024 edition of ITAMantics, where George, Rich and Ryan discuss the month’s ITAM news. Up for discussion this month are. Listen to the full ITAMantics podcast above or queue it up from ...